CompTIA Security+ Certification

Security Management

Risk Management Strategies

Risk management is a vital component of security management and governance. Every organization defines a certain level of risk it is prepared to accept, based on its risk appetite and risk tolerance. Risk appetite is an organization's willingness to take risks, while risk tolerance reflects the level of risk an organization can endure to achieve its goals.

A practical analogy for understanding these concepts is comparing them to eating at a buffet. Your appetite determines how much food you desire, whereas your tolerance indicates how much you can consume before feeling unwell. Ultimately, your appetite drives your decision to continue eating or to stop—this mirrors how risk appetite influences organizational decisions.

Key Insight

There are four primary risk management strategies: transfer, accept, avoid, and mitigate. Each strategy plays a unique role in addressing the various types of risks an organization may encounter.

Risk Management Strategies Explained

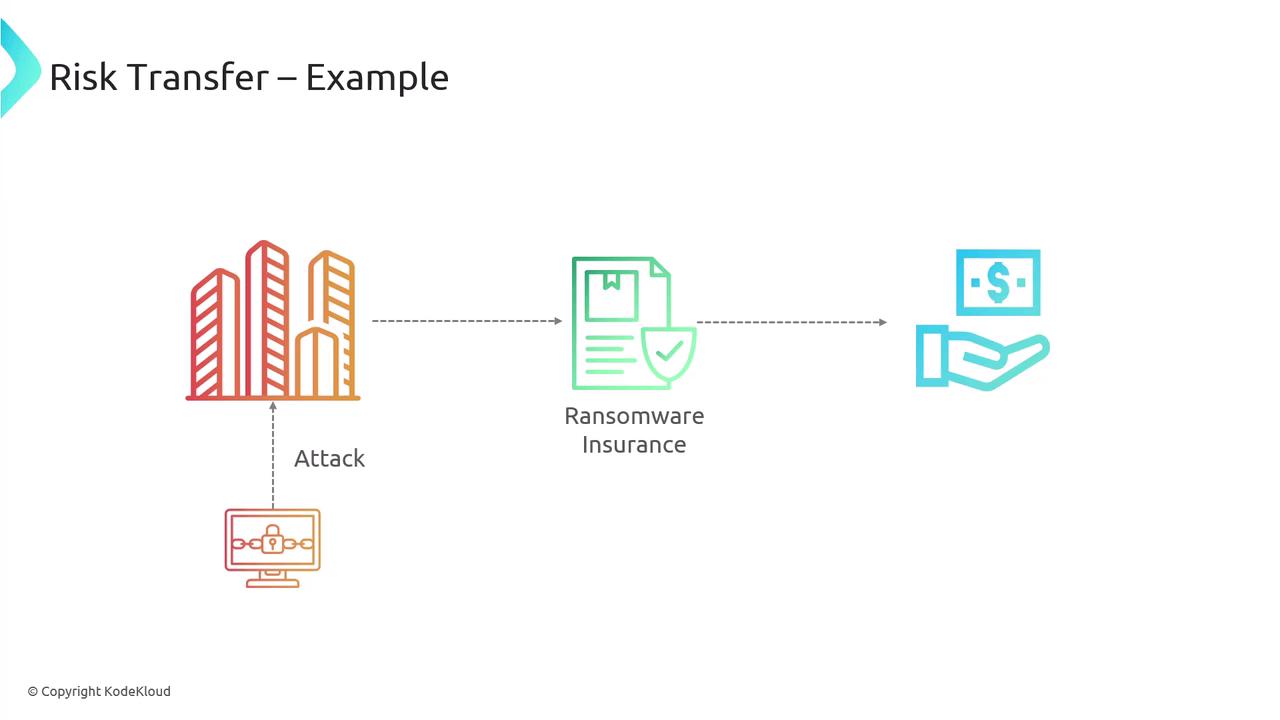

Risk Transfer

This strategy involves shifting the risk to a third party. A common example is purchasing insurance. For instance, many companies buy ransomware insurance to cover any costs associated with a cyber-attack, effectively transferring the financial risk.

Risk Acceptance

When the cost of mitigating a risk is too high or the asset is not critical, the organization might decide to accept the risk. This means recognizing the possibility of a threat and choosing not to invest further in risk reduction.

Risk Avoidance

In this approach, an organization opts out of using a technology, process, or system that may expose it to potential risks. By avoiding the risky element altogether, the organization sidesteps associated vulnerabilities.Risk Mitigation

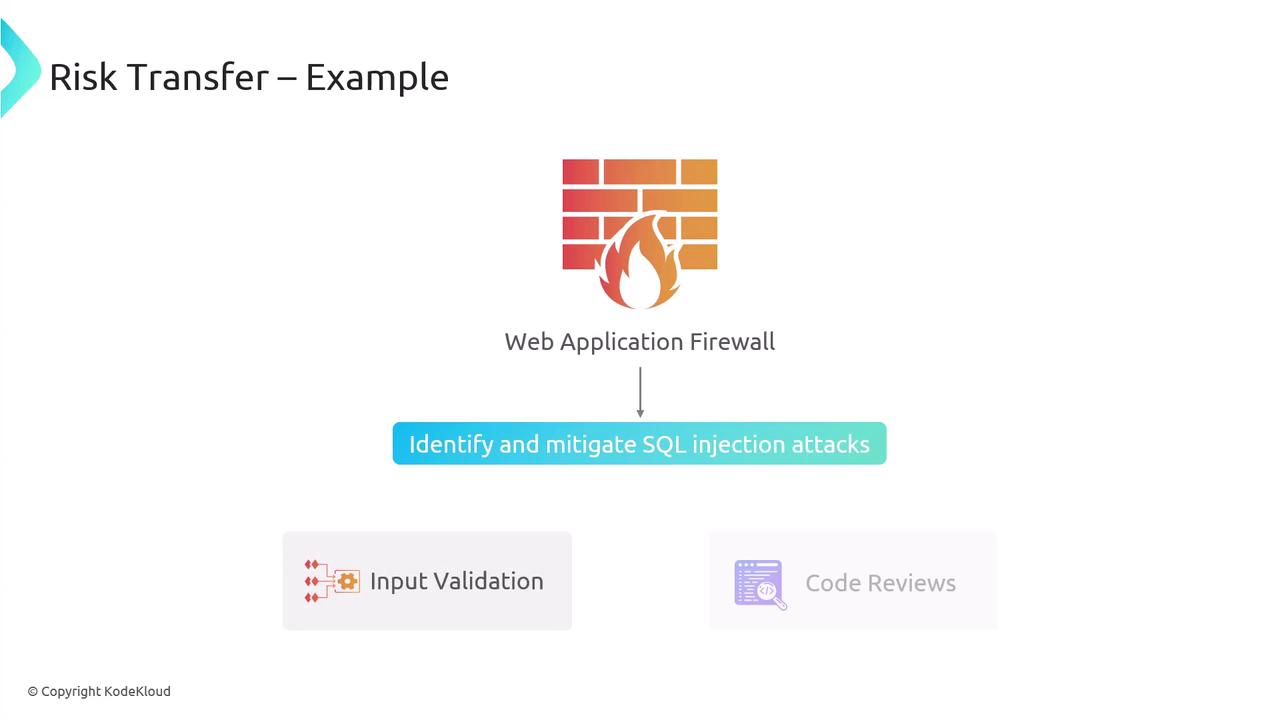

Mitigation focuses on reducing either the likelihood or the impact of potential risks. For example, deploying a web application firewall that works alongside input validation and code reviews can significantly decrease the chance of suffering a SQL injection attack.

An Illustrative Scenario

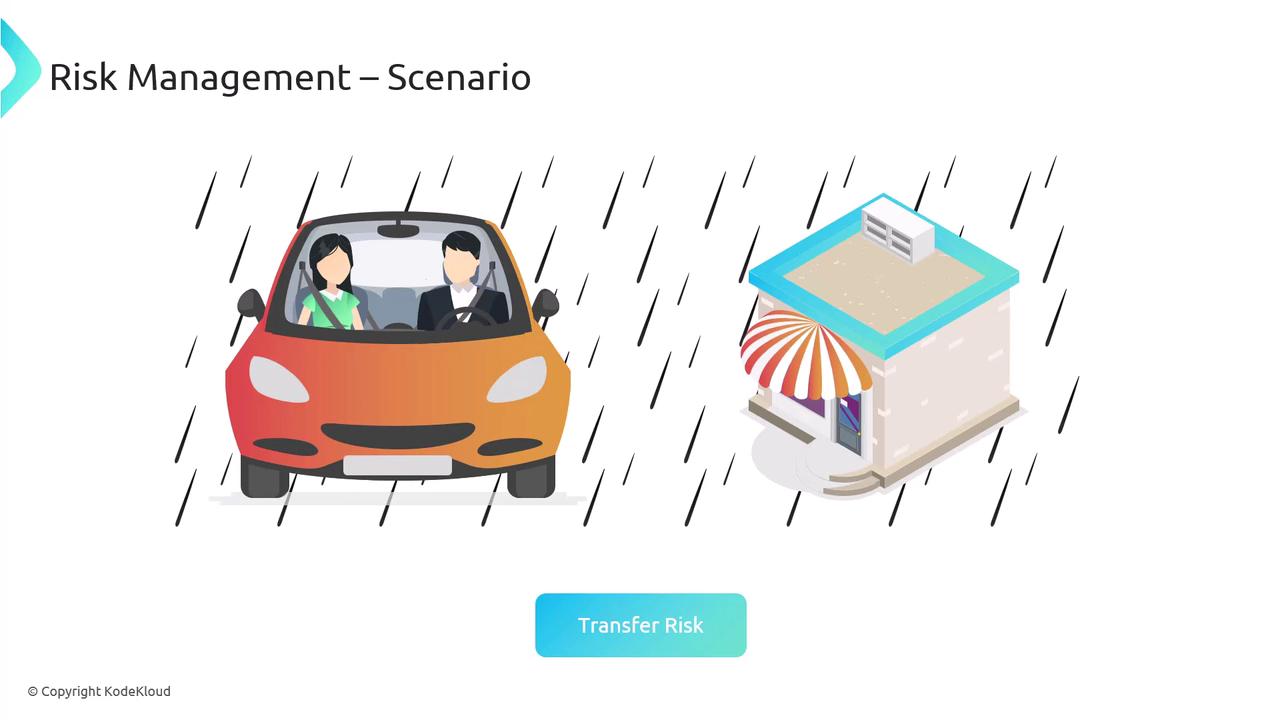

Imagine you are dressed in your finest attire for an important event where you will be honored and photographed. On your way, you plan to stop by a store. Suddenly, a heavy rainstorm starts before you can get out of the car. Exiting the car in the rain poses a risk to your appearance.

Here are your options:

- Avoid the Risk: Do not stop at the store and continue driving.

- Accept the Risk: Exit the car despite the rain and get wet.

- Mitigate the Risk: Use an umbrella or other protective measures before stepping out.

- Transfer the Risk: Have a passenger or someone else run the errand on your behalf.

By understanding and applying these risk management strategies, organizations can better align their security measures with their overall risk tolerance and appetite, ensuring a balanced approach to safeguarding operations and assets.

For additional details on risk management best practices, explore our related resources and articles on security strategies.

Watch Video

Watch video content