Importance of PCI Compliance

Imagine making an online purchase. Every time you use your credit card, PCI compliance plays a crucial role in protecting your transaction from cyber threats. By enforcing robust security measures and protocols, this standard minimizes vulnerabilities in payment systems and defends against potential financial fraud.Key Benefits of PCI Compliance

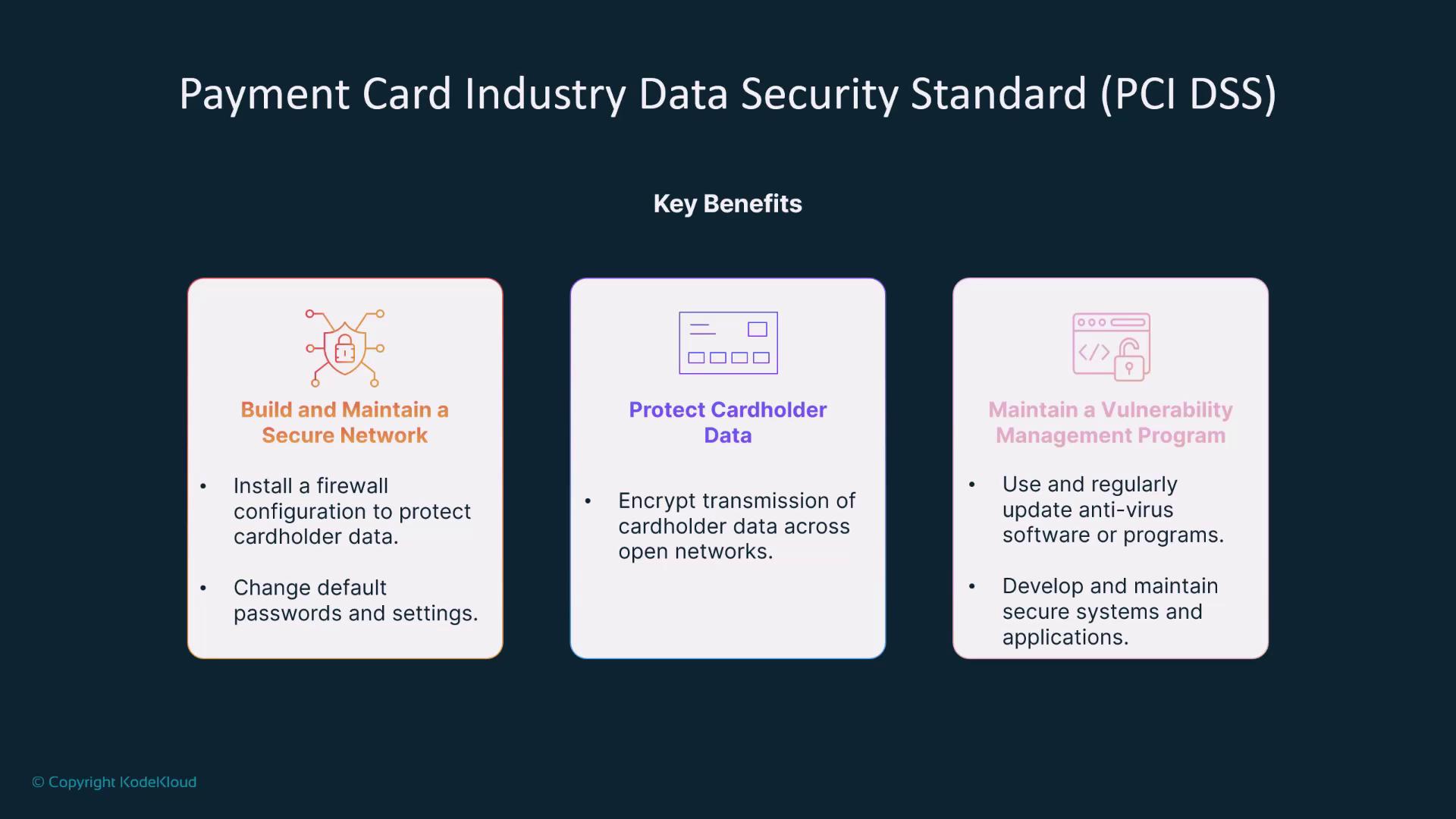

PCI compliance enhances security by focusing on five main areas:1. Building and Maintaining a Secure Network

A secure network is the foundation of PCI compliance. This includes implementing firewalls and changing default passwords to safeguard cardholder data. For instance, a retailer might use firewalls to block unauthorized access, while payment processors encrypt sensitive credit card information during transactions.2. Maintaining a Vulnerability Management Program

Effective vulnerability management involves the deployment of antivirus software and regularly updating systems to address emerging threats. For example, an e-commerce platform might consistently update its security software to ensure that evolving risks are mitigated.

3. Implementing Strong Access Controls

Robust access control measures ensure that only authorized personnel can access cardholder data, thereby promoting accountability. Assigning unique IDs to each employee and routinely monitoring access attempts to servers are common practices that help secure systems.4. Regularly Monitoring and Testing Networks

Continuous monitoring and testing of networks are critical for early detection of security breaches. This proactive approach enables organizations to promptly address any issues, thereby enhancing overall security.

5. Maintaining an Information Security Policy

A clear and comprehensive information security policy ensures that all employees understand and adhere to security protocols. This documented approach reinforces the organization’s commitment to safeguarding customer data.It is essential for businesses to integrate these security measures to not only comply with PCI DSS but also to build customer trust.

Consequences of Non-Compliance

Non-compliance with PCI standards can result in significant consequences. Organizations may face hefty fines from payment card providers, increased transaction fees, or even the loss of credit card processing privileges. For example, a small business experiencing a data breach might not only incur financial penalties but also suffer severe damage to its reputation and customer trust.

Remember: Ignoring PCI compliance is not an option. Ensuring adherence to these standards is vital for the protection of both business assets and customer information.